Like all fiscal product or service, limited-time period loans come with pluses and minuses. In this article’s what you have to know:

Some bank cards provide 0% fascination for an introductory interval, making the advance seem to be alluring. Unfortunately, borrowing an excessive amount cash in opposition to a bank card may lead to substantial debts, unmanageable regular monthly payments, and even successful over the credit history rating in the event you don’t make payments in time or Have a very lousy credit rating utilization ratio.

You’ll have the possibility to point out lenders you can also make well timed payments. As an installment personal loan, it may additionally boost your credit rating combine. With time, a private mortgage could lengthen your credit rating history.

Make sure you consult with our phrases of use For extra stipulations, also to Rocket Loans' privacy discover and Cross River's privateness detect To find out more about what we do with your own facts. For California residents, please begin to see the California money privacy choose-out kind.

Earn around 5% cash back in home loan personal savings on each individual faucet or swipe - using the card created with residence in your mind.

Acquiring prequalified for just a bank loan can present you with a preview of no matter whether you may be accredited and at what potential price and phrases, without having influencing your credit score score.

When you investigate quick-term loans, you will discover numerous options. Every mortgage gives various pros and cons. Right here’s what to know about Every brief-term mortgage supplied by lenders.

Even though a brief-time period mortgage may perhaps offer short term assistance, it could place you inside of a worse fiscal situation for the long run.

Transparency: We consider private financial loan conditions ought to be uncomplicated to find and decipher. Prequalification, which lets you Verify what rate you could qualify for and not using a hard credit inquiry, is particularly crucial. We also Check out to find out if a lender has been not too long ago penalized by regulators.

The Ohio guidelines from discrimination have to have that every one creditors make credit score Similarly accessible click here to all credit score deserving prospects, and that credit reporting organizations retain different credit rating histories on Each and every person on request. The Ohio Civil Legal rights Commission administers compliance using this type of regulation.

APR reveals the yearly expense of borrowing, such as desire and fees. Speak to your lender for particular aspects about your personal loan terms. How can I repay my loan?

Critique your personal loan presents. Limited-phrase lenders typically supply a list of qualified loans and their corresponding terms. You should acquire the checklist rather speedily –about an hour When you utilize to obtain prequalified. Always compare provides from other lenders ahead of agreeing to any conditions.

Editorial Take note: We receive a commission from companion one-way links on Forbes Advisor. Commissions will not have an effect on our editors' thoughts or evaluations. Once you borrow a personal personal loan, you can select repayment phrases that suit your funds.

Lower fascination prices. Personal loans with shorter financial loan terms commonly have reduced desire charges.

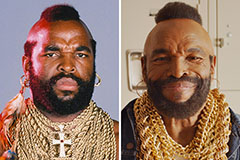

Mr. T Then & Now!

Mr. T Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now!